Attorney-Verified Loan Agreement Document for California State

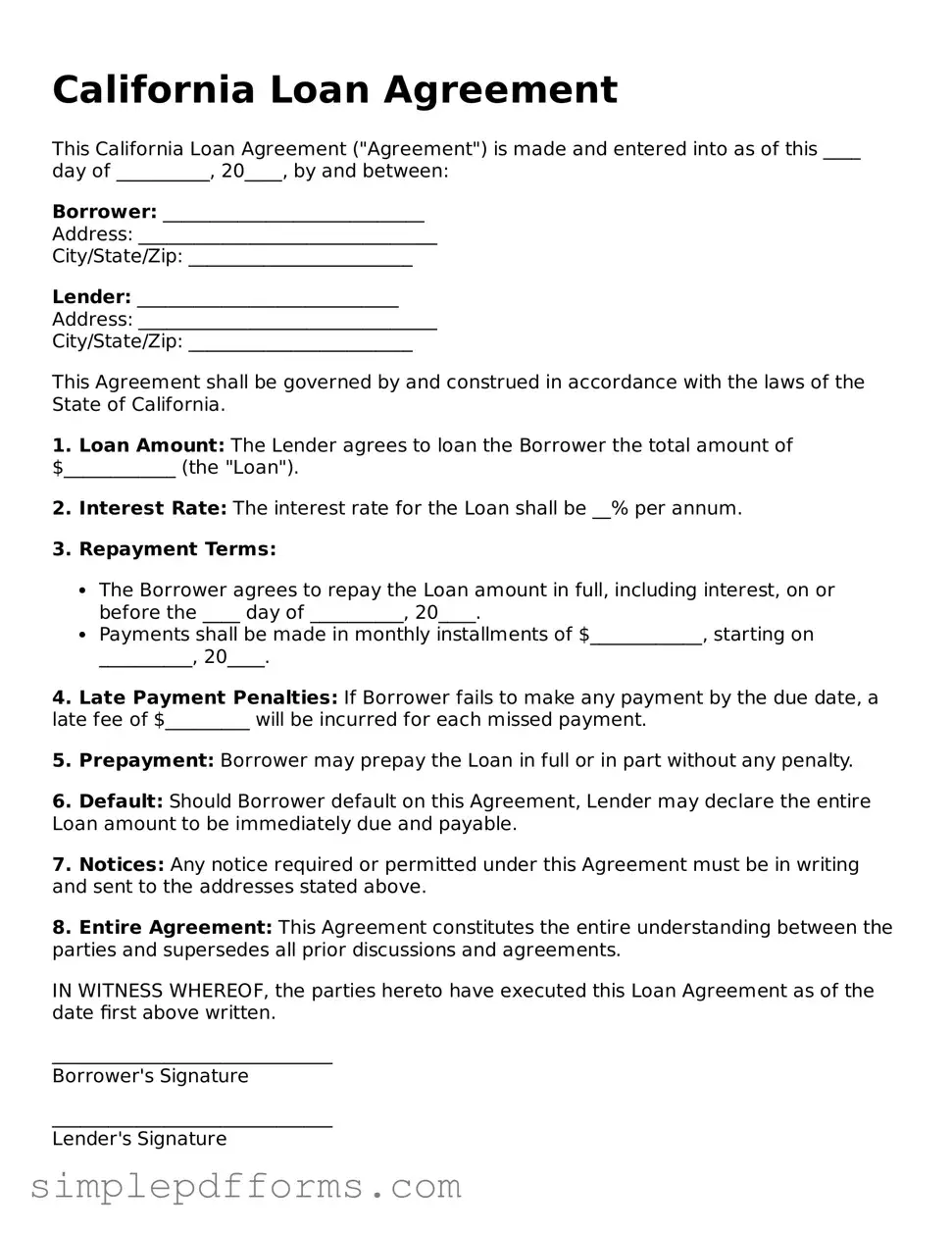

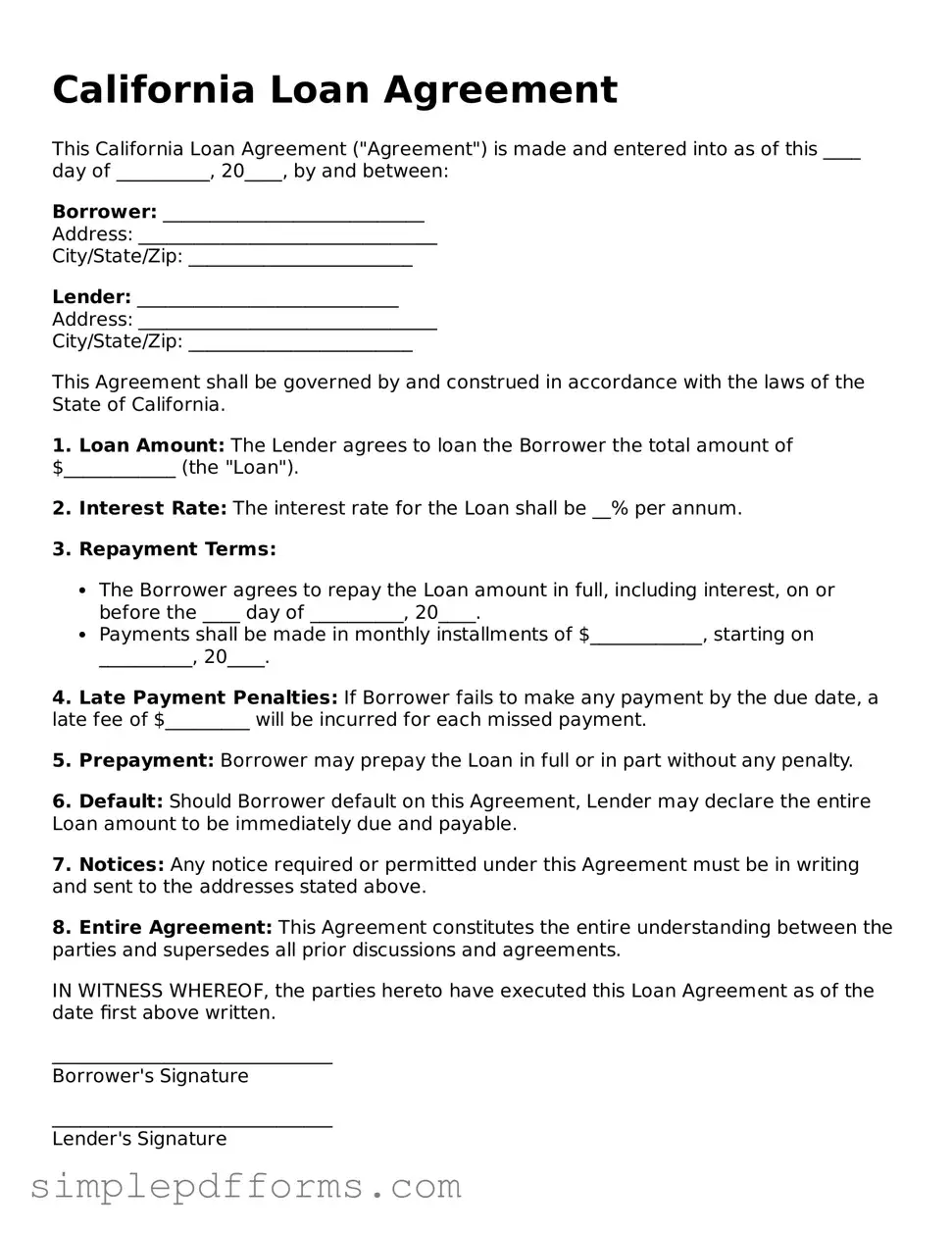

A California Loan Agreement form is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. This form protects both parties by clearly detailing repayment schedules, interest rates, and consequences for default. Understanding its components is essential for anyone entering into a loan arrangement in California.

Open Loan Agreement Editor Now

Attorney-Verified Loan Agreement Document for California State

Open Loan Agreement Editor Now

Open Loan Agreement Editor Now

or

Get Loan Agreement PDF Form

Your form is waiting for completion

Complete Loan Agreement online in minutes with ease.