Attorney-Verified Durable Power of Attorney Document for California State

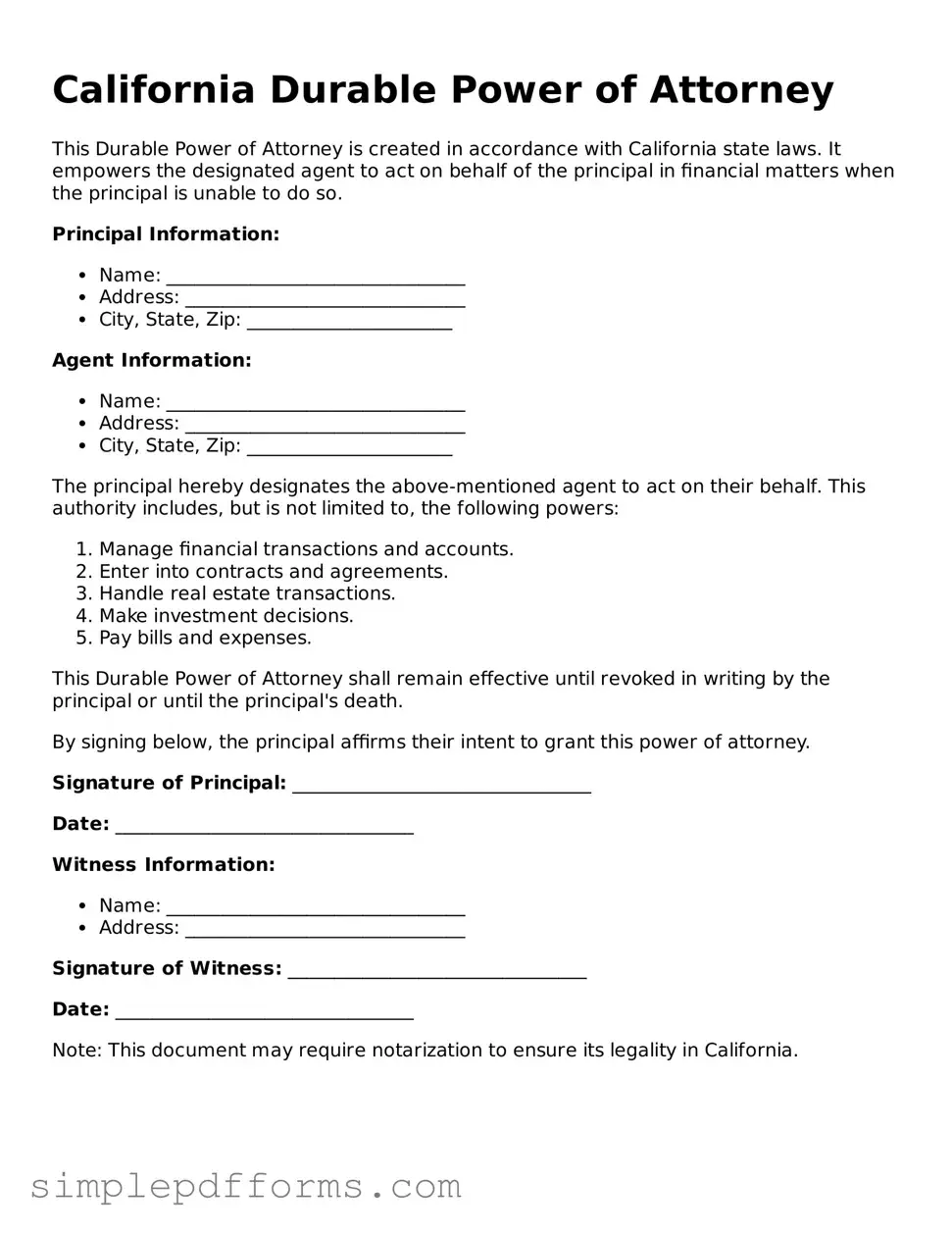

A California Durable Power of Attorney form is a legal document that allows someone to make decisions on your behalf if you become unable to do so. This form ensures that your financial and medical matters are handled according to your wishes. By appointing a trusted individual, you can have peace of mind knowing that your interests are protected.

Open Durable Power of Attorney Editor Now

Attorney-Verified Durable Power of Attorney Document for California State

Open Durable Power of Attorney Editor Now

Open Durable Power of Attorney Editor Now

or

Get Durable Power of Attorney PDF Form

Your form is waiting for completion

Complete Durable Power of Attorney online in minutes with ease.