Attorney-Verified Deed Document for California State

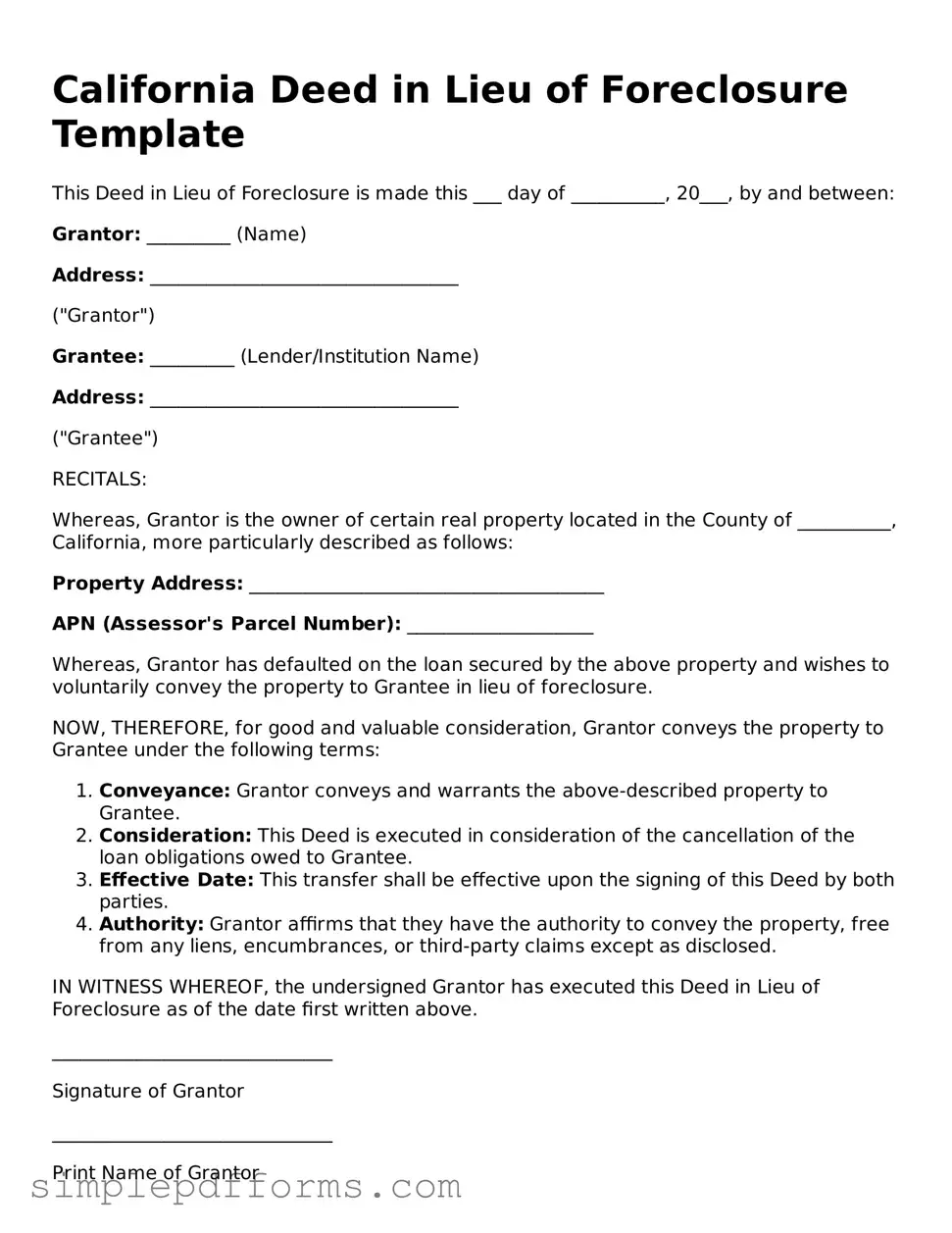

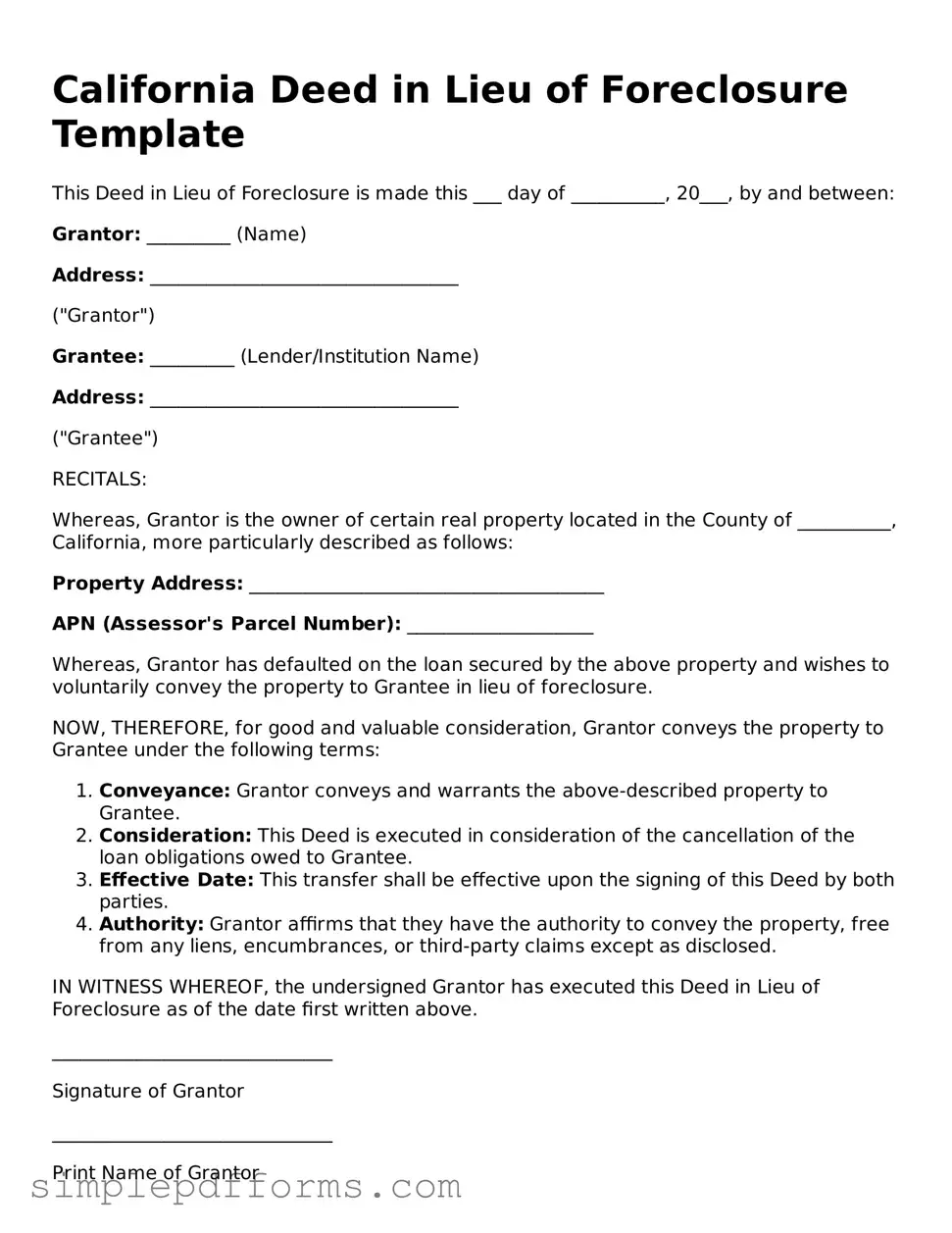

A California Deed form is a legal document used to transfer ownership of real property in the state of California. This form serves as a crucial tool in real estate transactions, ensuring that the transfer of property rights is documented and recognized by law. Understanding its components and requirements is essential for both buyers and sellers in the real estate market.

Open Deed Editor Now

Attorney-Verified Deed Document for California State

Open Deed Editor Now

Open Deed Editor Now

or

Get Deed PDF Form

Your form is waiting for completion

Complete Deed online in minutes with ease.