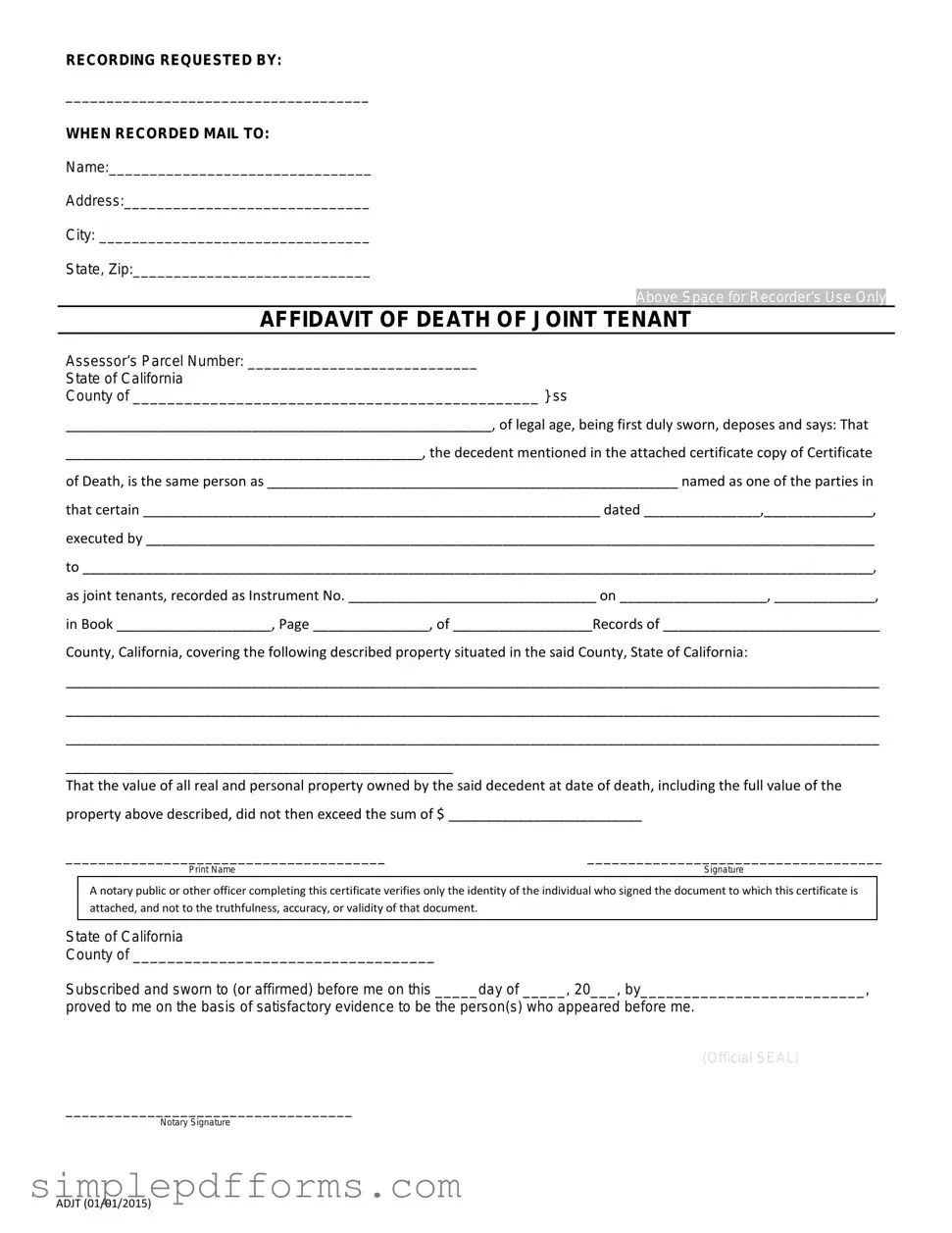

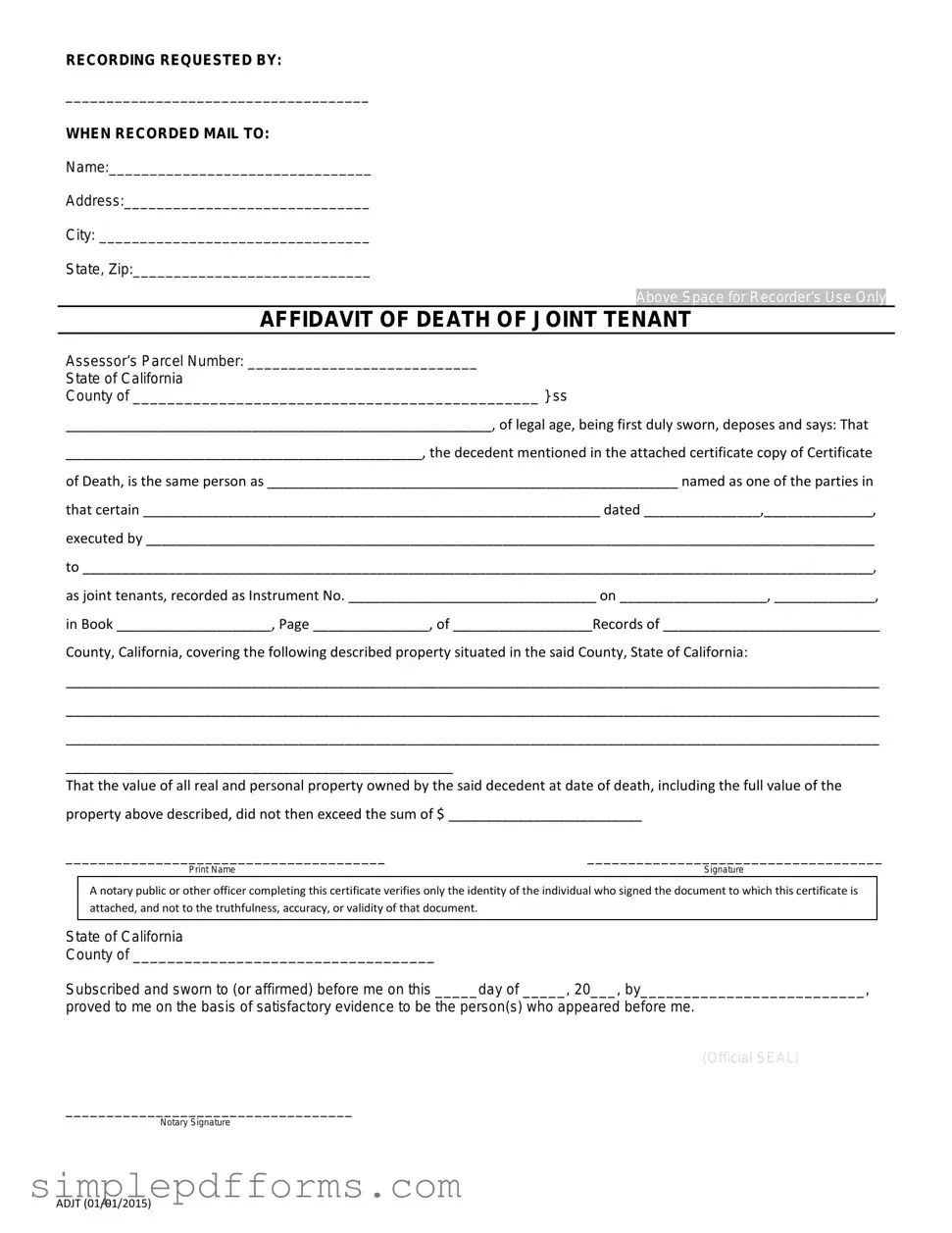

Fill a Valid California Death of a Joint Tenant Affidavit Form

The California Death of a Joint Tenant Affidavit is a legal document used to transfer ownership of property when one joint tenant passes away. This form simplifies the process of transferring the deceased’s interest in the property to the surviving joint tenant(s). Understanding how to properly complete and file this affidavit can help ensure a smooth transition of property rights and responsibilities.

Open California Death of a Joint Tenant Affidavit Editor Now

Fill a Valid California Death of a Joint Tenant Affidavit Form

Open California Death of a Joint Tenant Affidavit Editor Now

Open California Death of a Joint Tenant Affidavit Editor Now

or

Get California Death of a Joint Tenant Affidavit PDF Form

Your form is waiting for completion

Complete California Death of a Joint Tenant Affidavit online in minutes with ease.