Attorney-Verified Articles of Incorporation Document for California State

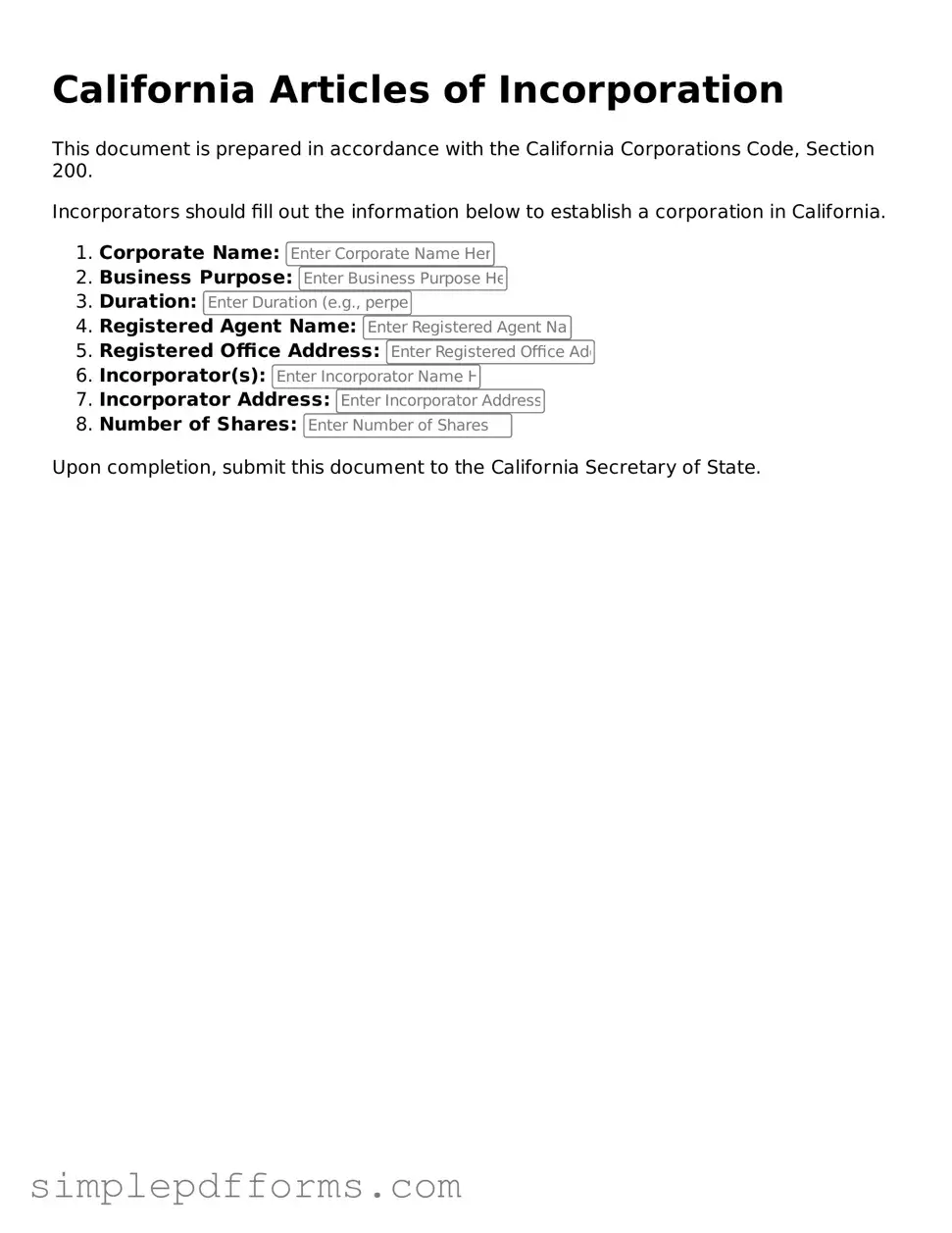

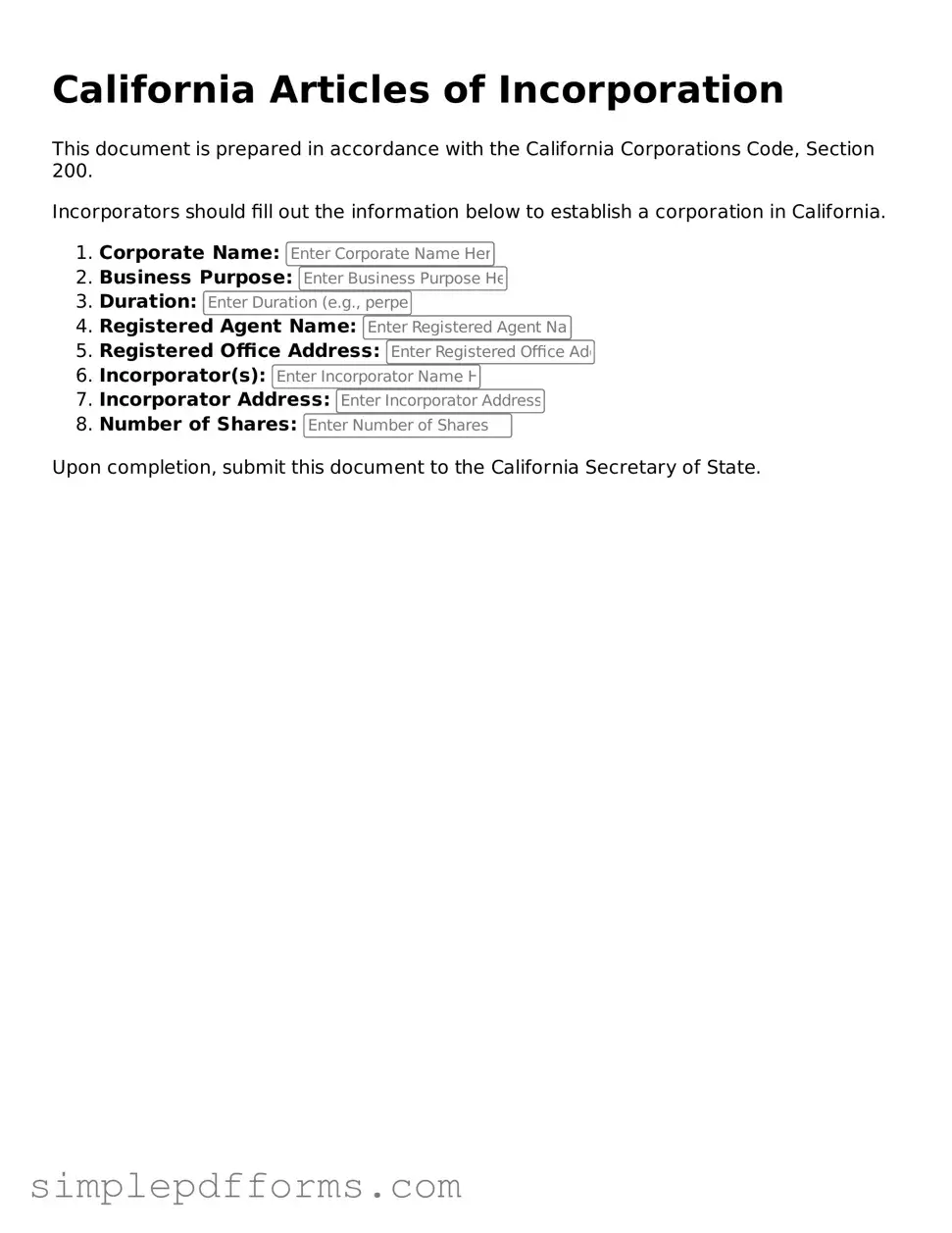

The California Articles of Incorporation form is a legal document required to establish a corporation in the state of California. This form outlines essential information about the corporation, including its name, purpose, and the details of its initial directors. Completing and filing this document is a crucial first step for anyone looking to create a business entity in California.

Open Articles of Incorporation Editor Now

Attorney-Verified Articles of Incorporation Document for California State

Open Articles of Incorporation Editor Now

Open Articles of Incorporation Editor Now

or

Get Articles of Incorporation PDF Form

Your form is waiting for completion

Complete Articles of Incorporation online in minutes with ease.