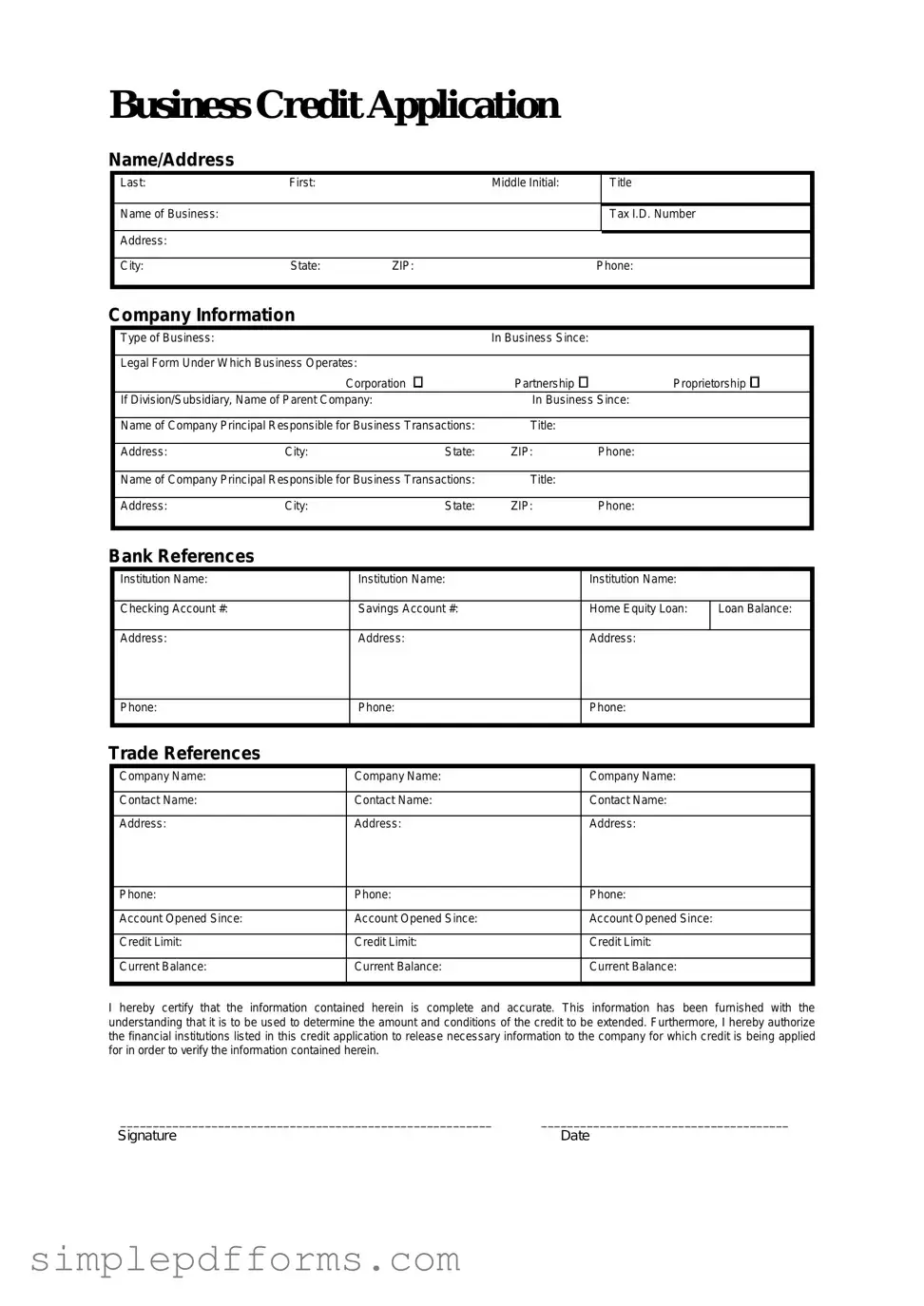

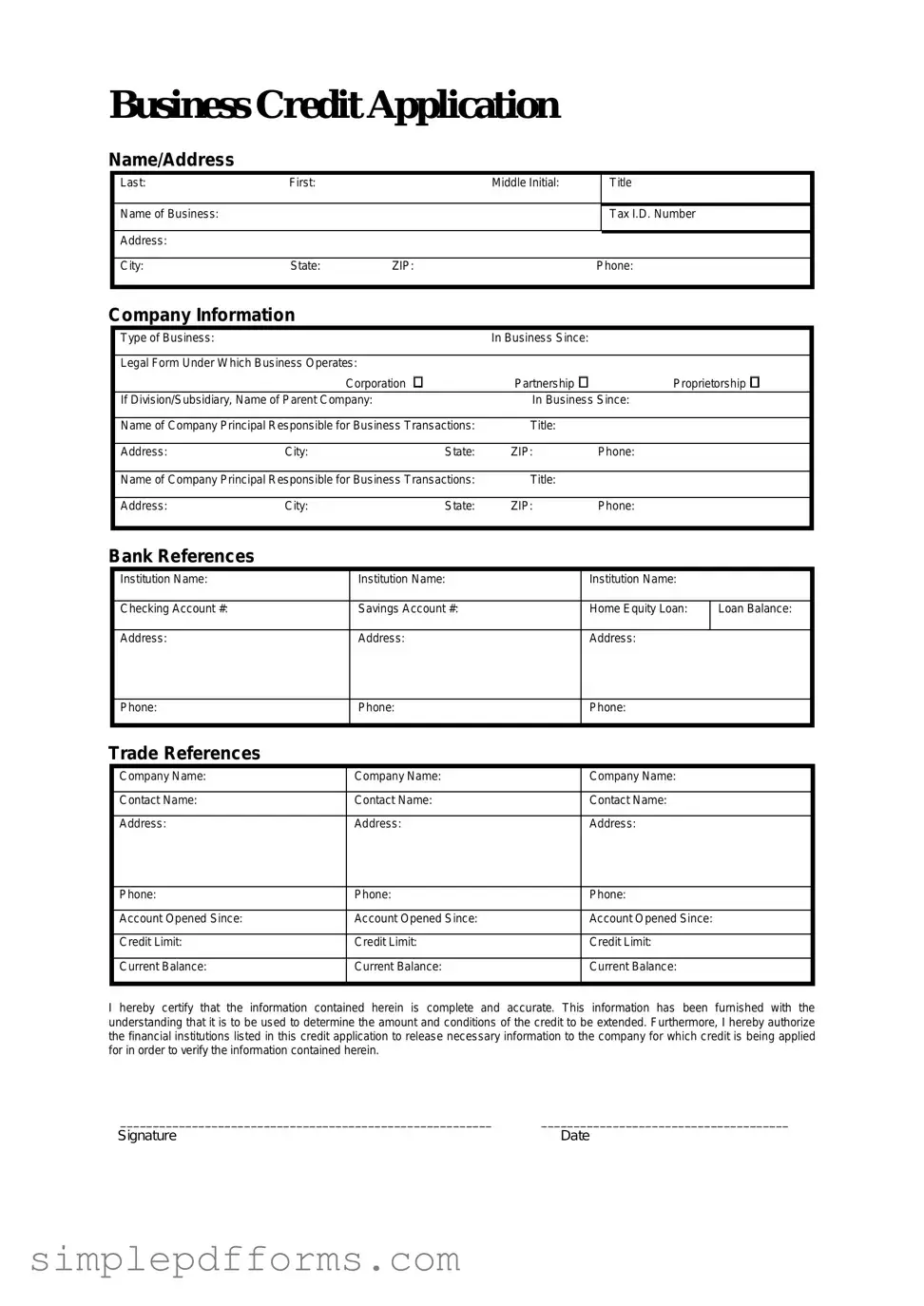

Fill a Valid Business Credit Application Form

The Business Credit Application form is a document that businesses complete to apply for credit from suppliers or lenders. This form collects essential information about the business, including its financial history and creditworthiness. By submitting this application, businesses can establish a line of credit that helps them manage cash flow and make purchases on credit.

Open Business Credit Application Editor Now

Fill a Valid Business Credit Application Form

Open Business Credit Application Editor Now

Open Business Credit Application Editor Now

or

Get Business Credit Application PDF Form

Your form is waiting for completion

Complete Business Credit Application online in minutes with ease.