Fill a Valid Broker Price Opinion Form

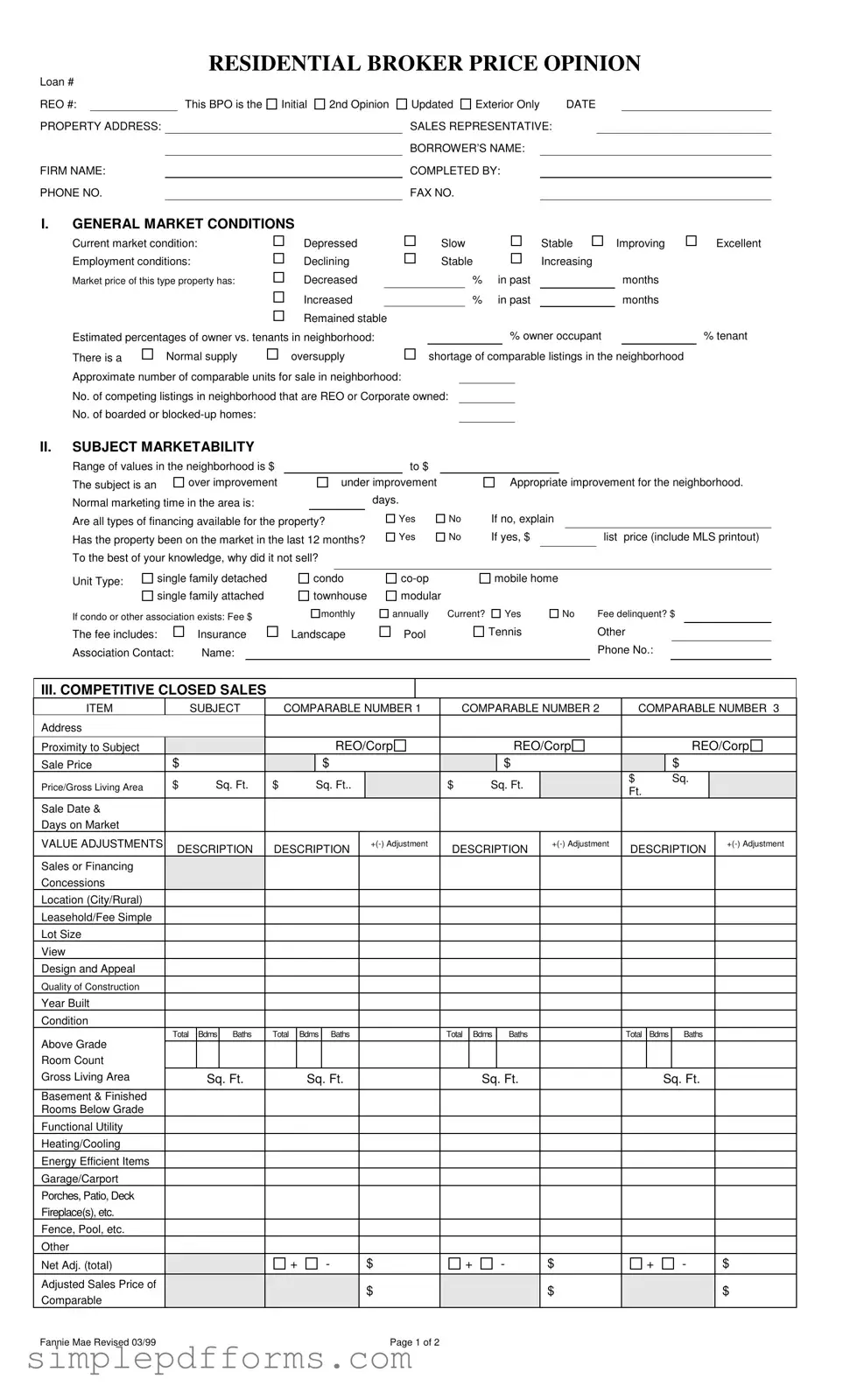

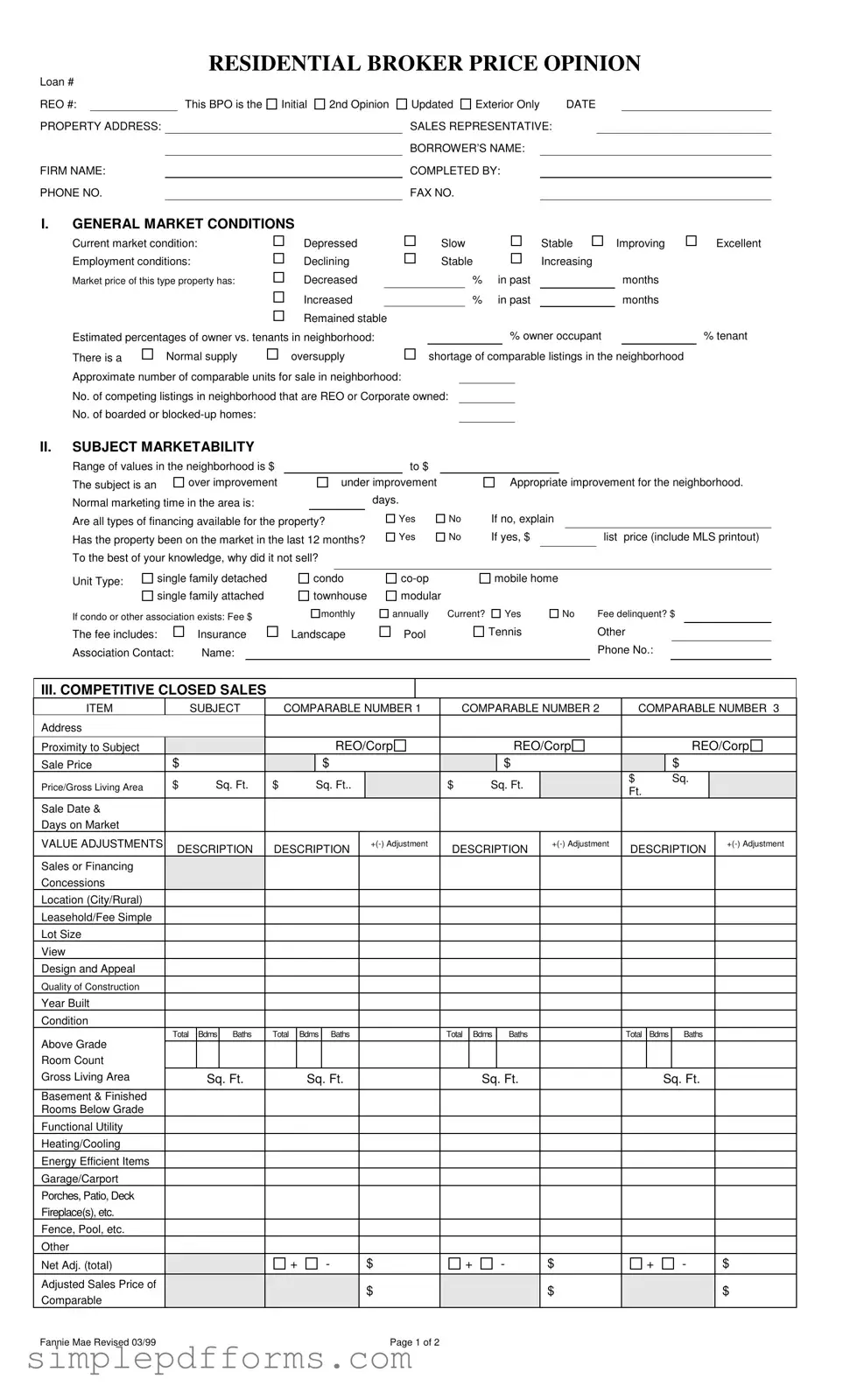

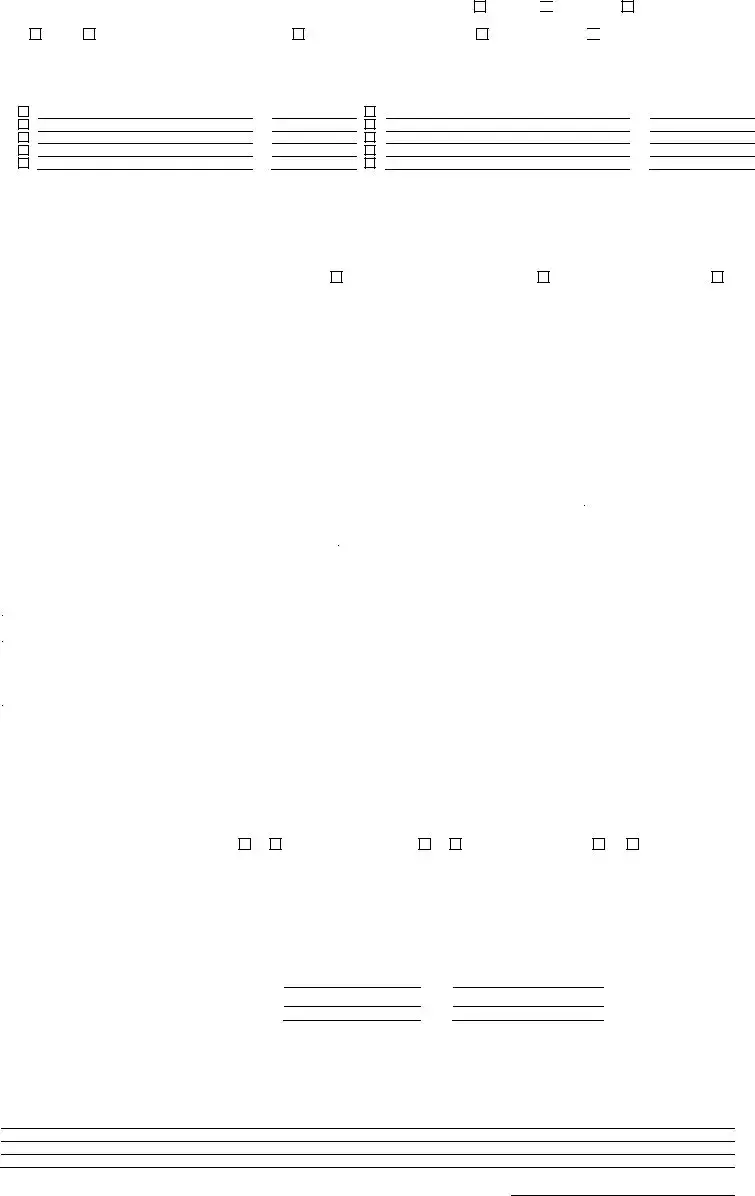

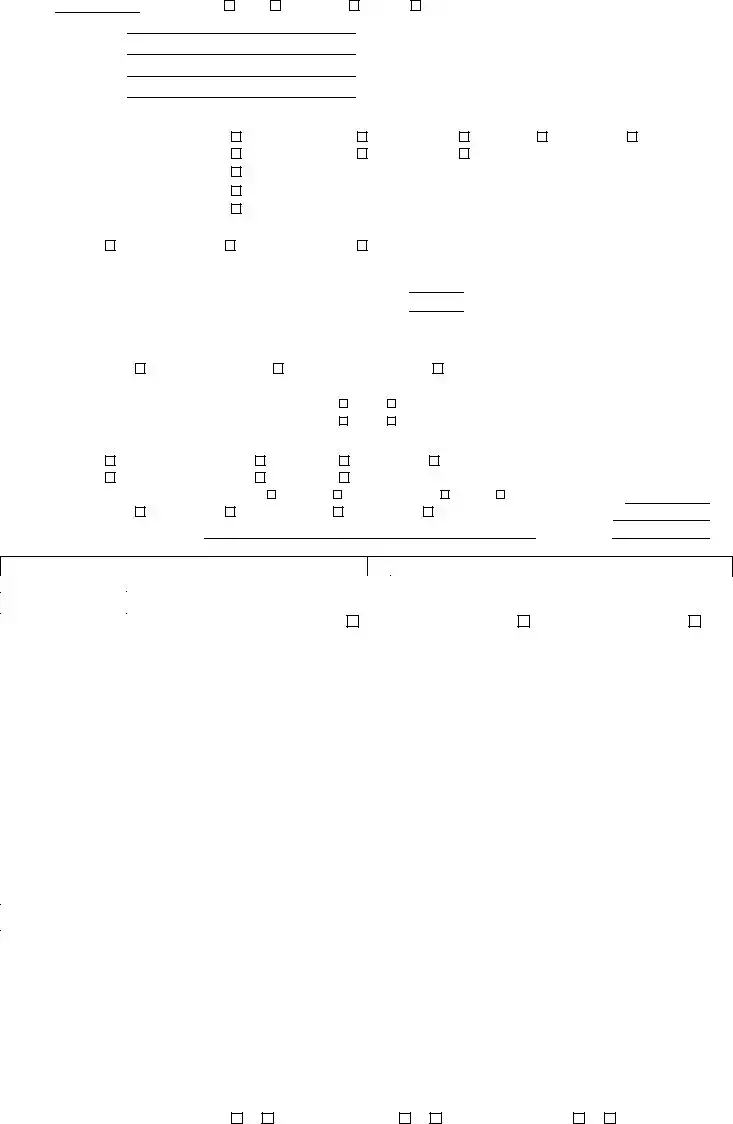

The Broker Price Opinion (BPO) form is a valuable tool used by real estate professionals to estimate the market value of a property. It provides a comprehensive analysis of current market conditions, comparable sales, and property characteristics. By utilizing this form, agents can offer insights that assist lenders and buyers in making informed decisions about real estate transactions.

Open Broker Price Opinion Editor Now

Fill a Valid Broker Price Opinion Form

Open Broker Price Opinion Editor Now

Open Broker Price Opinion Editor Now

or

Get Broker Price Opinion PDF Form

Your form is waiting for completion

Complete Broker Price Opinion online in minutes with ease.

Unknown

Unknown

Investor

Investor