Free Bill of Sale Form

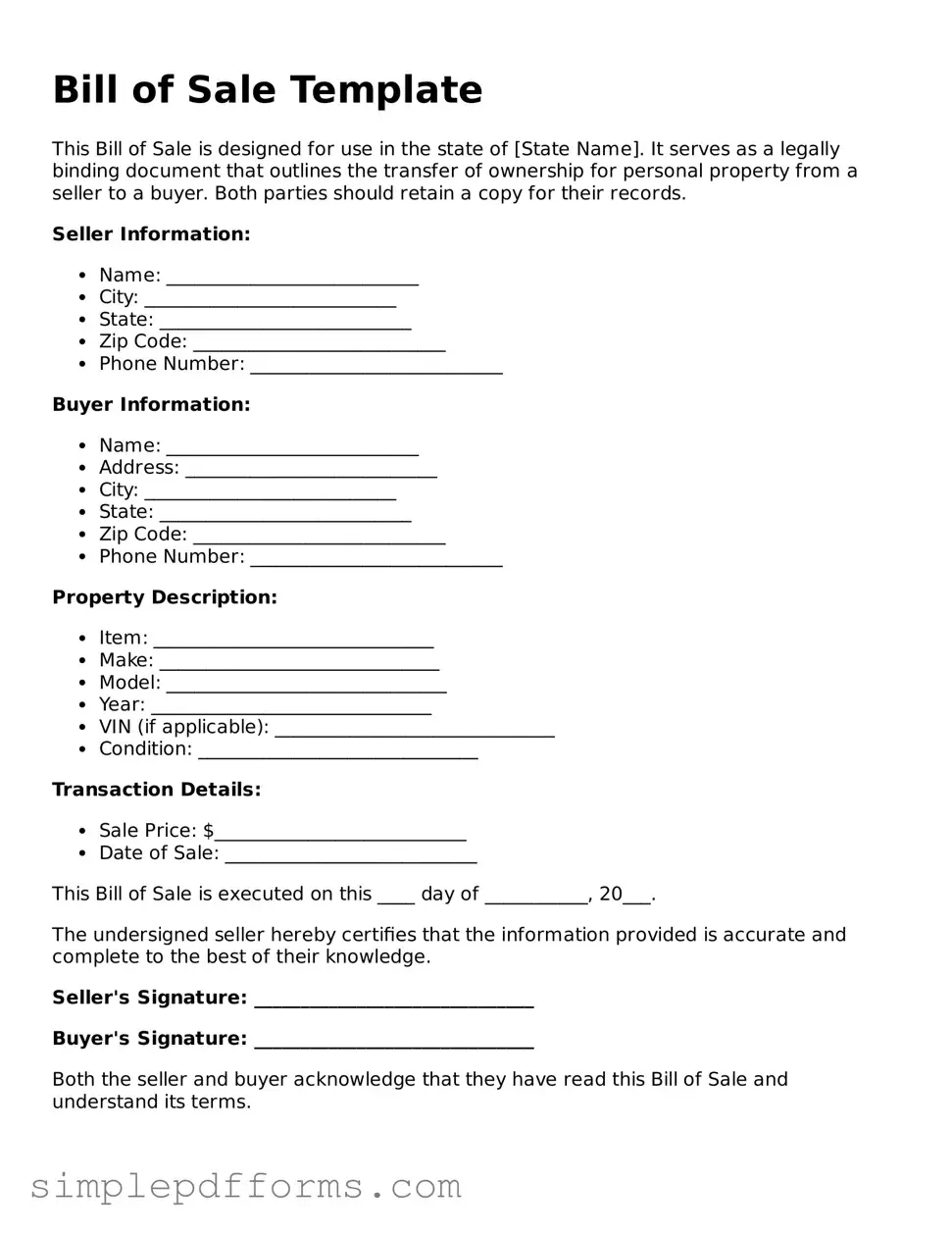

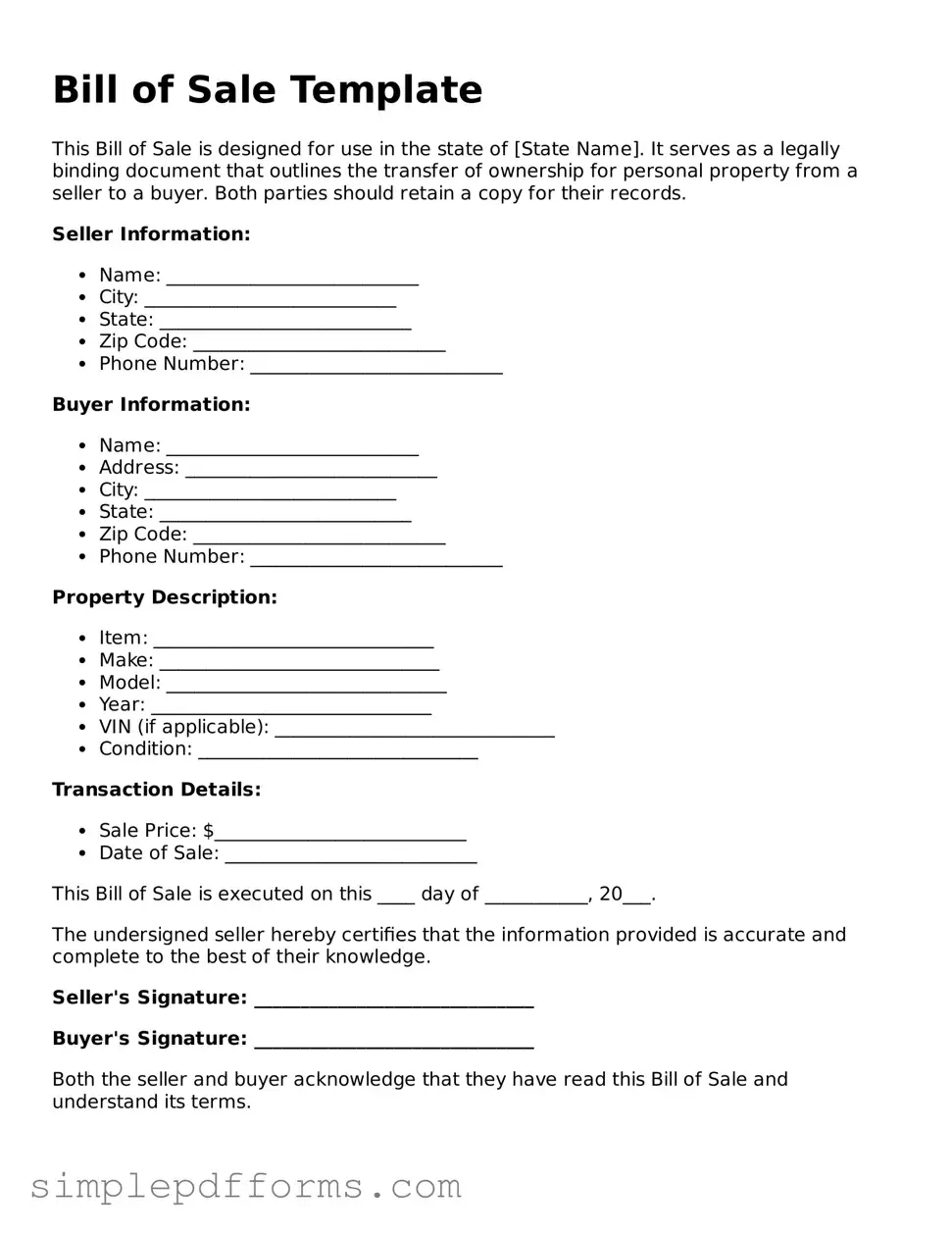

A Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof of the transaction, detailing the item being sold, the sale price, and the identities of both the buyer and seller. Understanding how to use this form can help ensure a smooth and transparent exchange.

Open Bill of Sale Editor Now

Free Bill of Sale Form

Open Bill of Sale Editor Now

Open Bill of Sale Editor Now

or

Get Bill of Sale PDF Form

Your form is waiting for completion

Complete Bill of Sale online in minutes with ease.