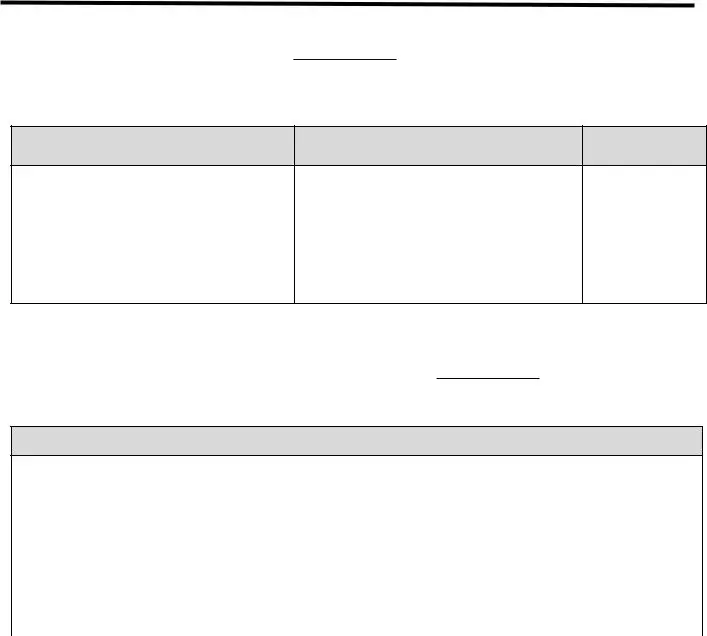

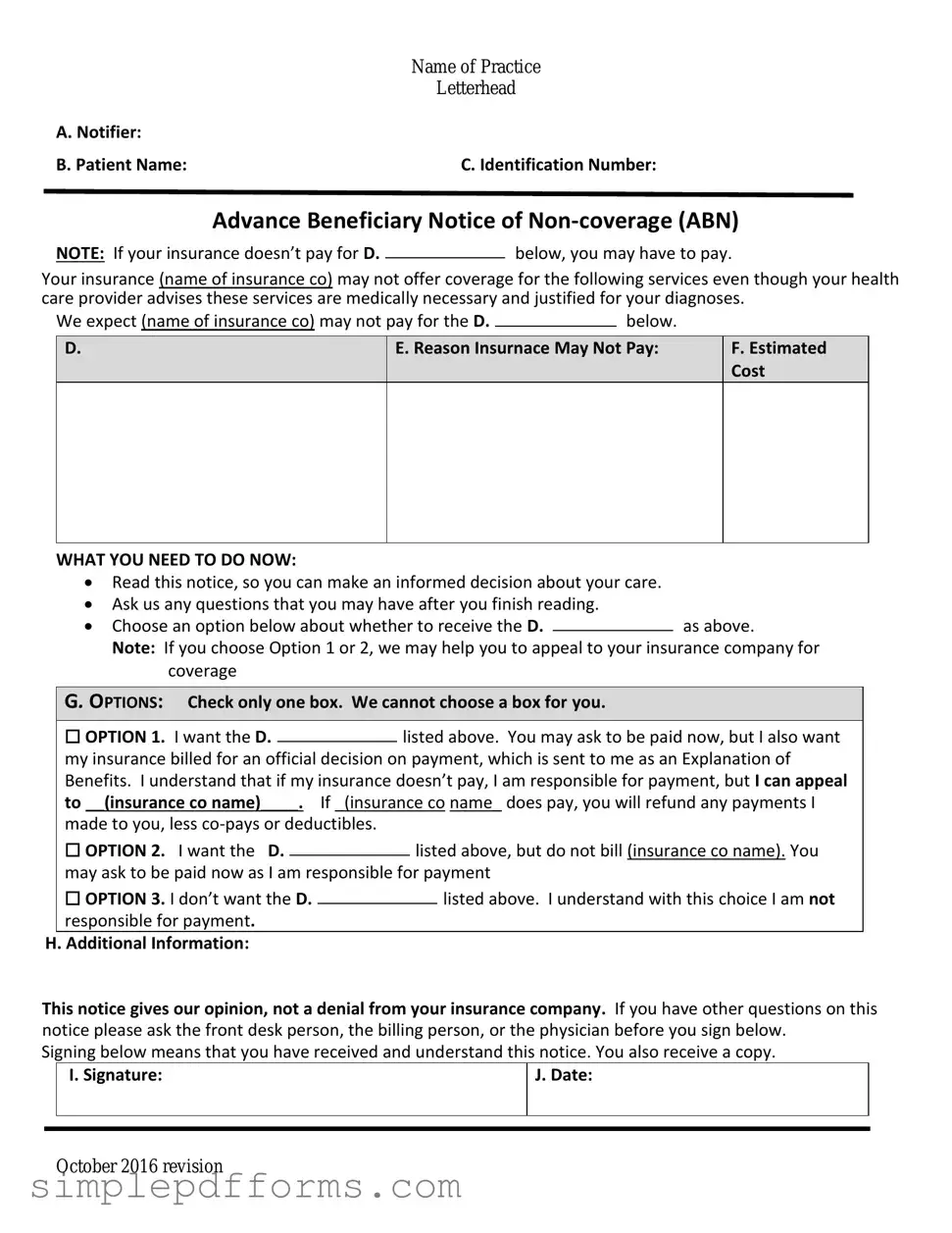

Fill a Valid Advance Beneficiary Notice of Non-coverage Form

The Advance Beneficiary Notice of Non-coverage (ABN) is a crucial document that informs Medicare beneficiaries when a service or item may not be covered by Medicare. This notice allows patients to make informed decisions about their healthcare and potential costs. Understanding the ABN can help avoid unexpected medical bills and ensure that beneficiaries are aware of their options.

Open Advance Beneficiary Notice of Non-coverage Editor Now

Fill a Valid Advance Beneficiary Notice of Non-coverage Form

Open Advance Beneficiary Notice of Non-coverage Editor Now

Open Advance Beneficiary Notice of Non-coverage Editor Now

or

Get Advance Beneficiary Notice of Non-coverage PDF Form

Your form is waiting for completion

Complete Advance Beneficiary Notice of Non-coverage online in minutes with ease.