Filling out the ADP Pay Stub form can seem straightforward, but many individuals make common mistakes that can lead to confusion or errors in their payroll. Understanding these pitfalls can help ensure accuracy and efficiency in processing payroll information.

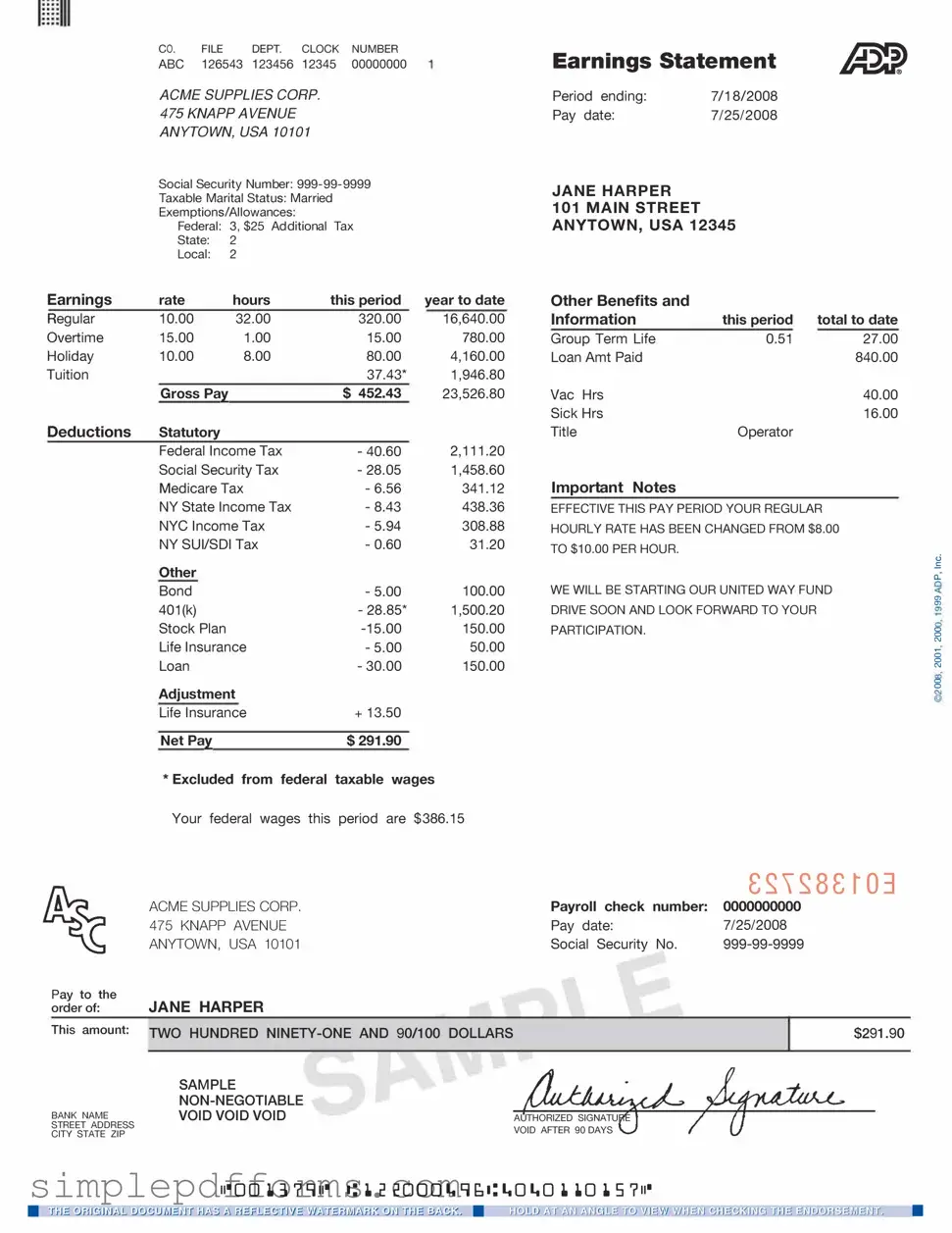

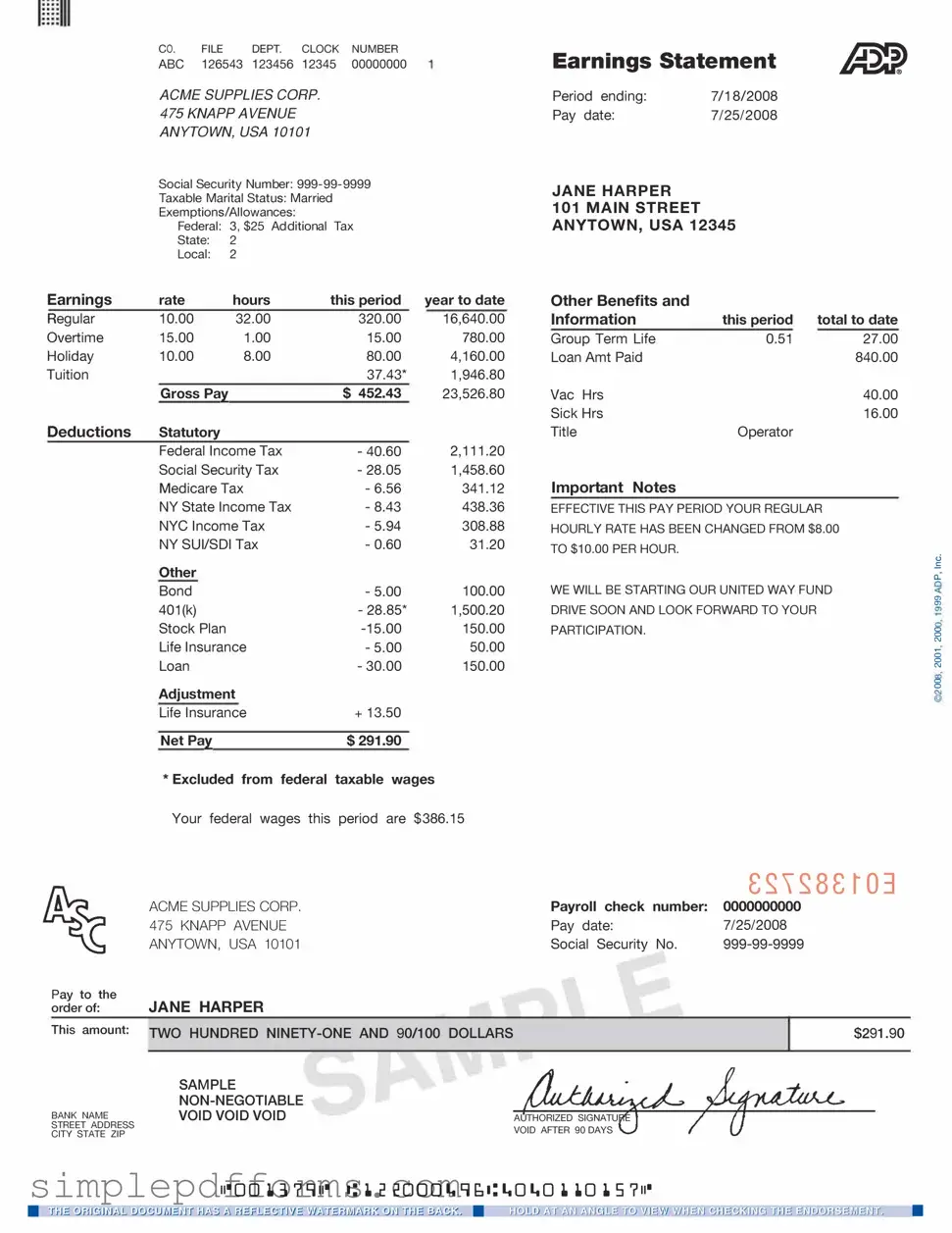

One frequent mistake is not double-checking personal information. Employees often overlook their name, address, or Social Security number. An incorrect entry can lead to significant issues, such as tax discrepancies or delayed payments.

Another common error is miscalculating hours worked. Some individuals may forget to include overtime or may misinterpret their work schedule. Accurate reporting of hours is crucial for receiving the correct pay, and mistakes here can affect not just the current paycheck but future calculations as well.

Many people also neglect to review their deductions. This includes federal and state taxes, retirement contributions, and health insurance premiums. If these deductions are inaccurately recorded, employees may end up underpaying or overpaying their taxes, leading to complications at tax time.

Additionally, some individuals fail to account for additional earnings such as bonuses or commissions. These should be clearly documented on the pay stub. If omitted, it could result in an inaccurate total that does not reflect the employee’s true earnings for the pay period.

Another mistake is ignoring the pay period dates. Employees sometimes fill out the form without paying attention to the specific dates for the pay period. This can cause discrepancies in payment and reporting, leading to confusion and potential disputes with employers.

Moreover, failing to update the form after changes in employment status is a common oversight. When someone moves from part-time to full-time or changes their tax filing status, they must ensure that the pay stub reflects these updates. Neglecting to do so can lead to incorrect tax withholding and benefits calculations.

Some employees also mistakenly assume that the form is optional. It is important to understand that the ADP Pay Stub form is a critical component of payroll processing. Ignoring it or submitting it late can disrupt the payroll cycle, affecting not just the individual but also the entire team.

Finally, many individuals do not seek help when they are unsure about how to fill out the form. Whether it’s contacting HR or consulting a payroll specialist, asking questions can prevent errors and ensure that the information is accurate and complete.