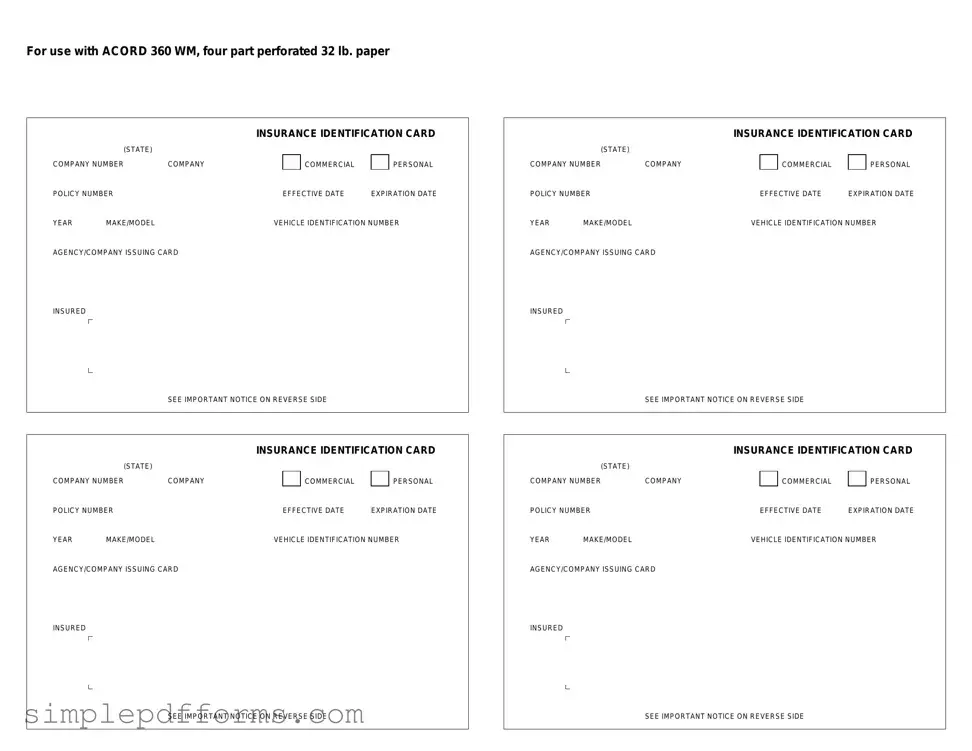

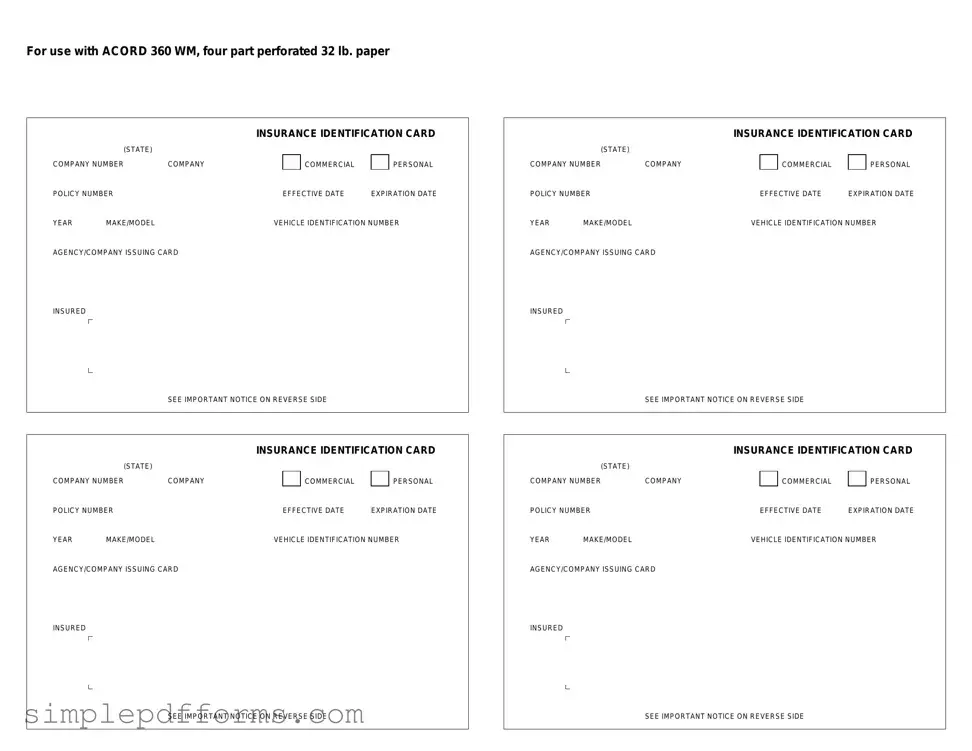

Fill a Valid Acord 50 WM Form

The Acord 50 WM form is a standardized document used in the insurance industry to collect essential information about workers' compensation coverage. This form serves as a crucial tool for businesses seeking to communicate their insurance needs effectively. Understanding its components is vital for ensuring compliance and securing adequate protection for employees.

Open Acord 50 WM Editor Now

Fill a Valid Acord 50 WM Form

Open Acord 50 WM Editor Now

Open Acord 50 WM Editor Now

or

Get Acord 50 WM PDF Form

Your form is waiting for completion

Complete Acord 50 WM online in minutes with ease.